How to be a successful sports bettor

Bankroll management

Now that you understand what expected value is and how positive expected value bets are recognised we can move onto the second most important concept in advantage sports betting: bankroll management.

Your bankroll management strategy dictates how much money to bet (stake size) based on how much money you have at your disposal (your bankroll). For example a $200 bankroll may allow for a $10 per bet stake size, while a $2000 bankroll may allow for a $100 per bet stake size.

For positive expected value betting, a quality bankroll management strategy should take into account the size of your bankroll, the amount of value present in a bet opportunity and the risk involved. All of these factors ensure you are maximising your profit while minimising the risk.

Kelly's Criterion

Kelly's Criterion is generally accepted as the superior strategy for bankroll management in sports betting. The strategy takes bankroll size, sportsbook odds and fair odds into account and returns a stake size. The Kelly's Criterion formula is expressed as follows:

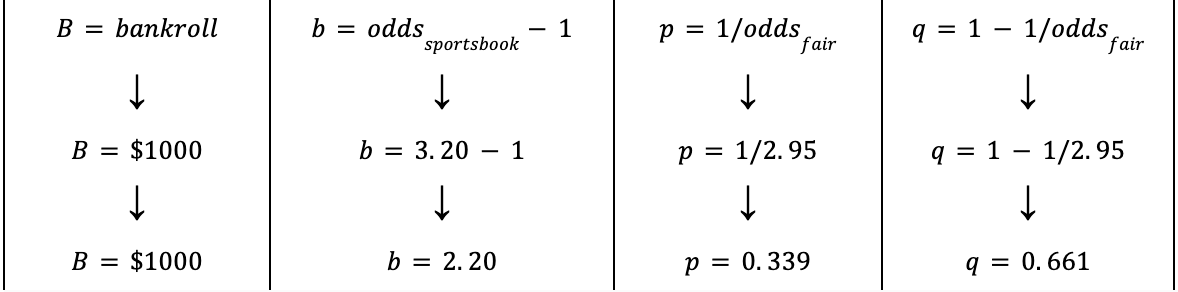

Let's break down this formula to better understand it.

• 'B' is the size of your bankroll

• 'b' is the sportsbook's odds minus 1 - this is the potential profit from the bet.

• 'p' is the probability of winning the bet or in other words the implied probability of the fair odds - this is the risk associated with the bet

• 'q' is the probability of losing the bet, which is simply 1 - 'p'

Substituting these variables that we are familiar with yields the following representation of Kelly's Criterion:

We have found a positive expected value bet where the odds offered by the sportsbook are 3.20 and we worked out the fair odds to be 2.95 for this event. In addition, we have dedicated $1000 as our bankroll for betting.

Entering these values into the Kelly's Criterion formula we can calculate our stake size:

Through this example we have calculated $38.55 to be the optimal stake size that will maximise profit while minimising risk

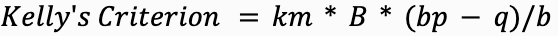

Kelly's Multiplier

Another form of the Kelly's Criterion formula exists, that involves a multiplier term 'km'. The Kelly's Multiplier is a term used to directly change the stake size based on the risk tolerance of an individual. For individuals who prefer to be more conservative with risk, they can decrease the Kelly's Multiplier factor, which by default is 1.

From our previous example, Kelly's Criterion outputted a stake size of $38.55. For a more conservative betting style, we may set Kelly's Multiplier to 0.5. This would result in our stake sizing halving, producing a stake size of $19.27 instead.

Variance

Understanding variance is key to becoming a successful sports bettor.

Over the long-term, our should be very close to our expected value, however, this is not the case for the short-term.

Variance is the short-term profit fluctuations when comparing to the expected value.

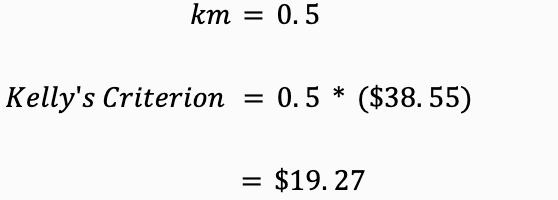

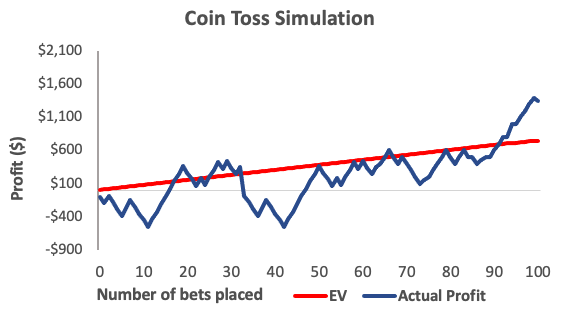

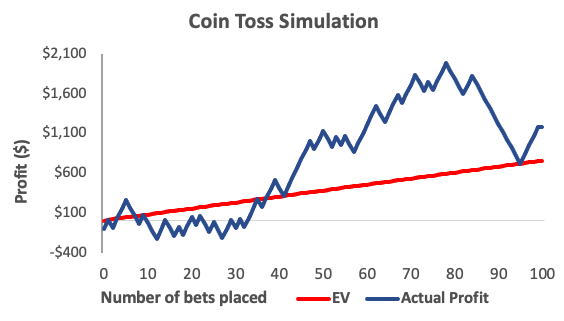

To visualise variance, let's run a coin toss simulator for 100 trials where the bet selection has an expected value of 7.5%.

Between the graphs we see a large variation with the 'actual profit' line. In the short-term there are winning and losing streaks, however, in the longer term we see a relatively similar profit value - ending close to what the expected value suggests.

A sophisticated staking system like Kelly's Criterion allows for your bankroll to survive the potential short term variance. Being consistent with your staking system and only placing positive expected value bets is the key to ensuring long-term profitability.

Bettors can decrease the amount of variance by choosing to only place bets with lower odds. For example, only placing bets with odds of under 4.0 will lead to far less variance than placing bets with odds of up to 20.0.

Closing line value

Closing line value is an important consideration when talking about improving our betting behaviours.

When placing bets with a positive expected value, we are taking into account the fair odds at that given time.

As we know, the odds will fluctuate, especially when close to the match start time, which can lead to changes in the fair odds -

the fair odds may increase and leave our bet now with a negative expected value (or a lower positive expected value), that previously had a positive expected value.

There is nothing we can do about the odds changing over time, and in general these odds differences will cancel each other out (sometimes the fair odds will increase, other times they will decrease).

We can, however, control how close to the match start time we place our bets. Placing bets close to the match start time (for example within 12 hours) will ensure we are more consistent with having a similar expected value at the time of placing the bet and at the start of the match.