Your First +EV Bet: A Step-by-Step Guide

Making your first +EV bet can seem daunting with so many numbers and metrics to understand. However, it's quite simple when broken down step by step.

In this guide, we'll cover the key principles of +EV betting: expected value (EV), variance, the Kelly criterion, bankroll management, and fair odds. This walkthrough is designed for beginners, so if you're interested in more advanced topics, we have a separate tutorial available here.

Bankroll Management

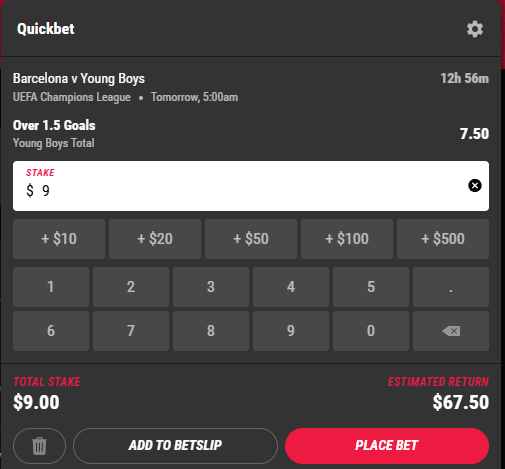

Your bankroll is the total amount of money you're willing to invest in +EV betting. A good starting point is between $500 and $1,000. The higher your bankroll, the more bets you can place, leading to more potential profit over time.

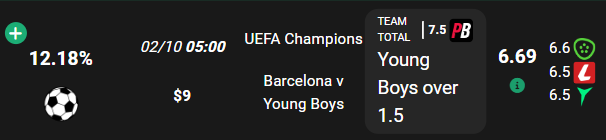

Expected Value (EV)

EV, or expected value, is the mathematical edge you have over the sportsbook for a particular bet. It's a long-term indicator of how much profit you can expect to make.

For example, if the EV is 10% and you stake $100, your long-term expected value would be $10.

Variance

Variance refers to the natural fluctuations in your betting results. Every bettor experiences winning and losing streaks, which are part of the variance.

- Positive variance can lead to short-term winning streaks, boosting your bankroll.

- Negative variance can result in losing streaks, even with a solid strategy.

The Kelly Criterion

The Kelly criterion is a formula that helps determine the optimal bet size based on the opportunity and your bankroll. It balances profitability and risk to help you make the most out of each bet. A higher kelly's criterion value will increase the stake size, and lower will reduce stake size. If you are risk-averse bettor, it would be wise to reduce your kelly's criterion to a smaller value.

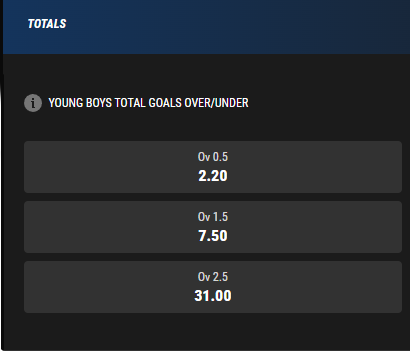

Fair Odds

Bookmaker odds often reflect a lower payout than the actual probability of an event, known as their margin. We calculate the fair odds by removing the margin and averaging odds across multiple bookmakers to give you a better representation of true probabilities.

Placing the Bet

Helpful Tips for +EV Betting

- Place as many bets as possible each day to maximize returns.

- Losing streaks due to variance are normal. Stay consistent.

- Focus on bets with an EV above 2% and avoid bets over 25% to prevent account restrictions.

- Bet closer to game time for a more accurate representation of true probabilities.

- Aim for a Closing Line Value (CLV) above 50% for a consistent edge over bookmakers.